Tuition fees are only one part of the cost of studying or working abroad. For many international students and professionals, the biggest financial shock comes after arrival, rent, food, transport, utilities, healthcare, and daily living expenses that were never fully planned for.

This is why a living expenses calculator has become one of the most searched tools by people planning international education, relocation, or overseas work. It helps answer a simple but critical question: Can I actually afford to live there?

Rather than relying on estimates, assumptions, or social media advice, understanding real living costs allows students and professionals to plan sustainably, avoid financial stress, and make informed long-term decisions.

This article breaks down how living expenses calculators work, what costs you must factor in, how expenses differ by country and city, and how to use cost planning as part of a smarter study or work-abroad strategy.

What Is a Living Expenses Calculator?

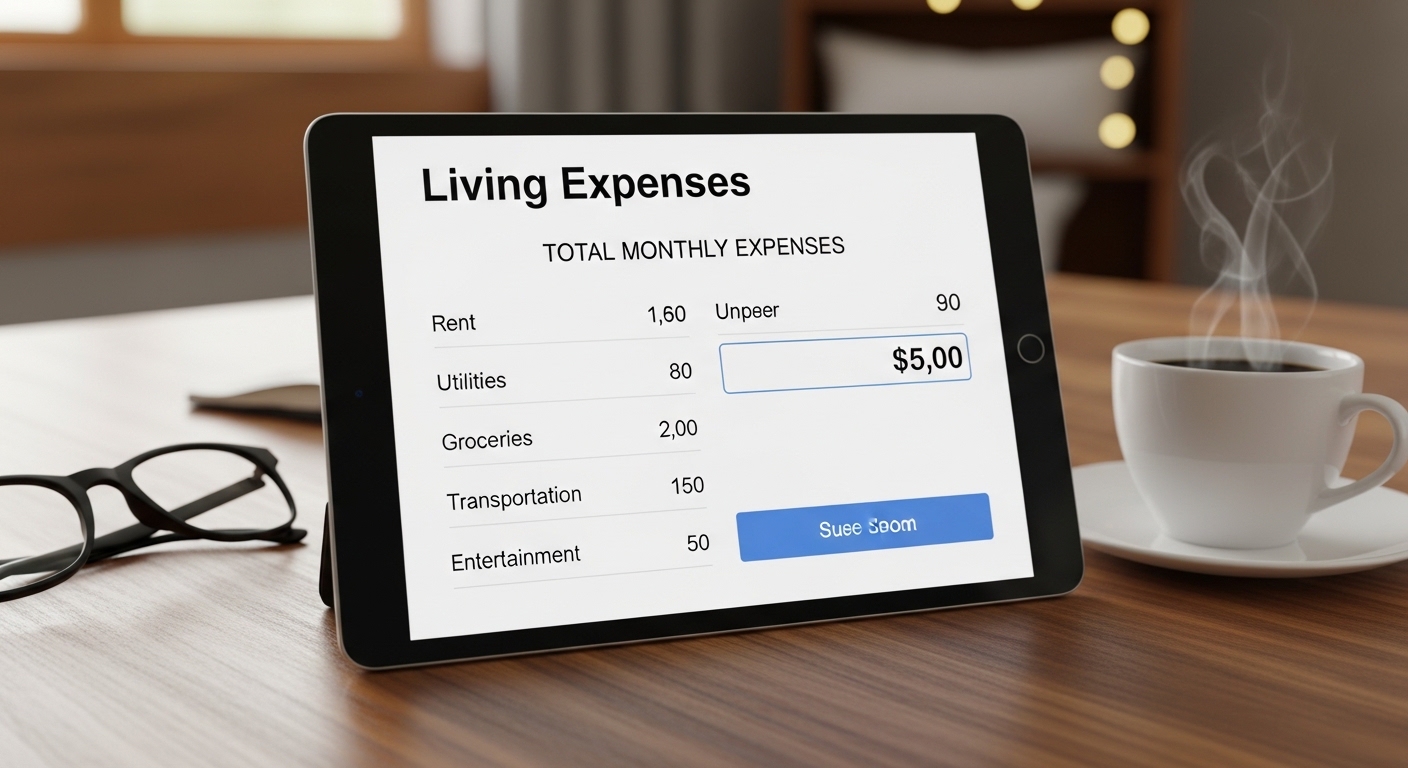

A living expenses calculator is a planning tool used to estimate the monthly or annual cost of living in a specific country or city. It combines average costs across essential categories to give a realistic picture of daily life expenses.

Unlike tuition calculators or visa financial requirements, living expenses calculators focus on actual lifestyle costs, not just minimum thresholds.

Typical categories include:

- Accommodation

- Food and groceries

- Transportation

- Utilities and internet

- Healthcare and insurance

- Personal expenses

- Study-related costs (where applicable)

For international students and expatriates, these calculators are especially useful because costs vary significantly by location, lifestyle, and housing choice.

Why Living Cost Planning Matters More Than Ever

In recent years, global living costs have risen sharply. Rent, energy, food prices, and transport fares have increased across the UK, Europe, North America, and parts of Asia.

Relying solely on Embassy minimums, University estimates, Advice from friends and Online anecdotesvcan leave major gaps in financial planning.

A realistic cost-of-living assessment helps you:

- Avoid running out of funds mid-study

- Reduce reliance on emergency work

- Make better housing decisions

- Choose locations that fit your budget

- Plan long-term, not just for arrival

Financial sustainability is now just as important as academic eligibility.

Key Living Expense Categories You Must Calculate

Accommodation Costs

Housing is usually the largest expense and costs vary based on:

- City vs smaller towns

- Shared vs private accommodation

- Student housing vs private rentals

- Proximity to campus or workplace

For example:

- Major cities typically have higher rent

- Smaller university towns may offer better value

- Shared housing significantly reduces costs

Accommodation alone can account for 30–50% of monthly expenses.

Food and Groceries

Food costs depend on lifestyle choices. Factors include:

- Cooking at home vs eating out

- Local food availability

- Cultural preferences

- Access to ethnic grocery stores

Students who cook regularly often spend significantly less than those who rely on restaurants or takeaway meals.

Transportation

Transport costs vary widely. Consider:

- Public transport availability

- Student or resident discounts

- Distance from accommodation to campus/work

- Need for occasional intercity travel

In many cities, public transport is cheaper and more predictable than owning a car.

Utilities and Internet

Often overlooked, but essential. These may include:

- Electricity

- Gas or heating

- Water

- Internet

- Mobile phone plans

Some rentals include utilities; others do not. Always confirm before budgeting.

Healthcare and Insurance

Healthcare costs differ by country. You may need to budget for:

- Mandatory health insurance

- Immigration health surcharges

- Private medical coverage

- Prescription medication

Healthcare expenses should never be ignored, even if usage is minimal.

Study-Related and Personal Costs

Additional expenses may include:

- Books and learning materials

- Software subscriptions

- Printing and supplies

- Clothing for climate changes

- Personal care

- Leisure and social activities

These smaller costs add up over time and should be included in realistic planning.

How Living Costs Differ by Country and City

Living expenses are not uniform across a country.

For example:

- Capital cities are often more expensive

- Smaller towns may offer similar education quality at lower cost

- Certain regions have better housing availability

- Transport infrastructure affects daily expenses

This is why calculators that allow city-level comparisons are more accurate than national averages.

Using a Living Expenses Calculator Effectively

A calculator is only as useful as the information you input.

To get realistic results:

- Choose the exact city, not just the country

- Select housing type accurately

- Include healthcare and insurance

- Add contingency costs

- Be honest about lifestyle habits

The goal is not to find the cheapest possible estimate, but a sustainable average you can live with comfortably.

Common Mistakes People Make When Estimating Living Costs

- Budgeting only for minimum visa requirements

Visa thresholds are not real-life budgets. - Ignoring inflation and rising costs

Costs change yearly; outdated figures lead to shortfalls. - Assuming part-time work will cover gaps

Work availability is not guaranteed. - Underestimating housing costs

Rent is often higher than expected. - Not planning for emergencies

Unexpected expenses happen everywhere.

Avoiding these mistakes starts with realistic cost planning.

Who Should Use a Living Expenses Calculator?

Living cost calculators are valuable for:

- International students

- Exchange students

- Postgraduate applicants

- Skilled workers relocating abroad

- Professionals considering overseas offers

- Families planning dependent relocation

Anyone making a long-term move benefits from understanding real living costs before committing.

Living Costs vs Lifestyle Choices

Two people in the same city can have very different expenses.

Costs depend on:

- Housing choices

- Spending habits

- Transport preferences

- Social lifestyle

- Travel frequency

A calculator provides a baseline, but your personal choices determine the final outcome.

Planning Beyond the First Year

Short-term affordability is not enough.

You should consider Multi-year cost sustainability, Tuition increases, Rent inflation, Currency fluctuations, Changes in work eligibility and Progression to post-study options.

Living cost planning should support long-term stability, not just initial arrival.

Conclusion

A living expenses calculator is more than a budgeting tool, it is a decision-making resource. It helps students and professionals move abroad with clarity rather than assumptions.

Understanding real costs allows you to choose destinations wisely, avoid financial stress, and focus on your academic or professional goals without constant financial pressure.

When combined with accurate tuition planning and realistic income expectations, living cost awareness becomes one of the strongest foundations for successful international mobility.

If you are considering studying abroad and want a clear picture of what life will actually cost while schooling, informed planning matters. SEA-FAJ Consults supports students in evaluating study destinations, living costs, and long-term sustainability, helping you make decisions that work beyond admission or arrival.

📩 Visit our website to explore options that work for you and Book a free consultation to plan your next move with financial clarity and confidence.

FAQs

1. What is the most accurate living expenses calculator?

The most accurate calculators allow city-level estimates and let users adjust lifestyle factors such as housing type, transport use, and food spending.

2. Do living expenses differ for students and non-students?

Yes. Students often benefit from discounted housing, transport passes, and insurance options, which reduce overall costs compared to non-students.

3. How much buffer should I add to my estimated living costs?

A buffer of 10–20% is recommended to cover emergencies, inflation, or unexpected expenses.

4. Can part-time work fully cover living expenses?

In some countries, part-time work can help offset costs but rarely covers all living expenses. Students should not rely on employment as their primary funding source.

5. Are smaller cities always cheaper for students?

Not always. While rent is usually lower, limited housing supply or transport costs can sometimes offset savings. Comparing cities carefully is essential.